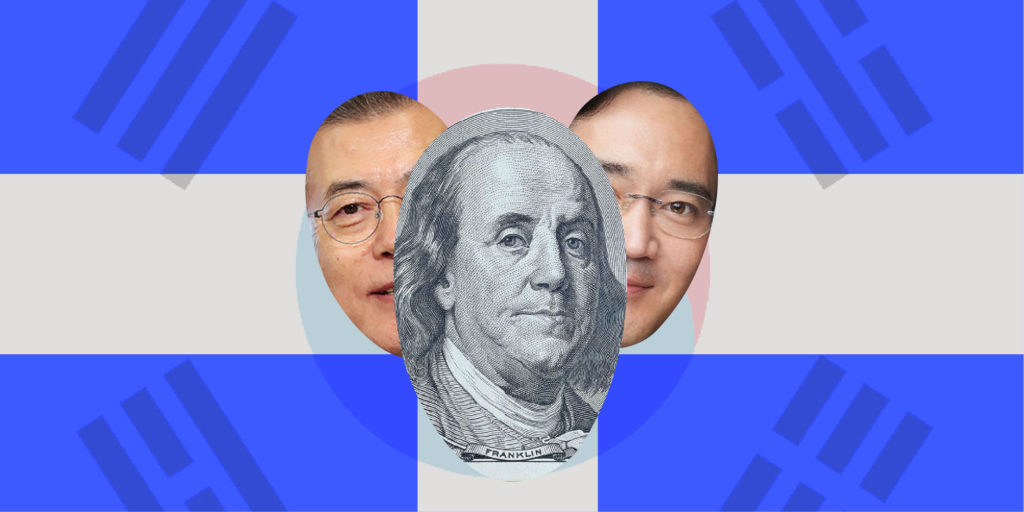

💵 The family of the Samsung Electronics chairman has been slapped with a hefty tax bill. They have to pay $10.8 Billion for inheritance tax.

This comes after the death of Lee Kun-hee, who passed away at the age of 78 leaving the massive 200 billion empire to his son. The only corporate heir – Lee Jae Yong.

But if only the tax is $10.8 billion, how much exactly is the inheritance?

💰 The shocking answer to this is, it’s just $20 billion. So, at a 50% inheritance tax rate in South Korea, the family is forced to pay such a hefty amount in taxes. South Korea ranks 2nd in terms of the rate of inheritance tax.

Japan tops the list by taxing 55%. 🤦♂️

Let’s dig a little deeper:

- This is the highest sum of inheritance taxes in South Korea

- It is more than 3 times the country’s total estate tax revenue for the previous year 😧

- It’s more than the GDPs of 48 countries individually including Maldives, Tajikistan, Kosova, etc.

- It’s more than the tax revenue of over 50 countries individually including Iceland, Indonesia, Uganda, etc

Paying a trillion won is no joke. So, will the family want to still remain in control of Samsung? 🤔

Luckily for them, the founder had a massive art collection valued at $1.76 billion which includes Picasso and Dali. This may help them to pay this huge amount. The family has decided to donate 23,000 art pieces to two-state museums.

Going on the philanthropic path, or just because it’s tax free?

The family is willing to donate $900 million to help fund infectious disease research and treatment of cancer and rare illness for children.

🗓️ The family has proposed to pay the hefty tax amount in 6 installments over five years. They are set to pay the first payment in May 2021.

So coming to the big question, Will the Lee family encash their shares in Samsung to raise cash?

Currently, there’s no such plan to do so. This is to ensure that the control of the company does not shift. The family is raising cash by using shares in affiliated companies as collateral for personal loans. The new heir, Lee Kun Hee recently got a huge dividend of 1 trillion won out of the total 13.1 trillion won paid by Samsung.

How did it affect Samsung?

The share price of Samsung C&T Corp dropped by 5.5% after the family made a statement to the press stating its civic duty and responsibility is to pay all taxes. Samsung Electronics shares closed down by a 1% dip and Samsung C&T saw a 3% dip.

The richest heir of South Korea is sentenced to 15 more months

😯 Lee Jae Yong is still serving a sentence of 30 months for his involvement in the 2016 corruption scandal and bribery. Not the best time to pay $10.8 billion for sure.

South Korea and Taxes

South Korea has such a high inheritance tax rate that the amount which is left after the deduction of taxes seems like nothing in terms of inheritance. Heir to the LG group found himself liable for taxes worth at least 900 billion won leaving them with just 170 billion won. Because of such a high inheritance tax rate, over 400 businesses up for sale in 2018. Huge companies are shifting their headquarters out of the South Korean economy to save themselves from such taxes.

One word can save you a lot of Money 💰

Marico sets a remarkable and innovative yardstick for companies to save themselves from taxes. Parachute oil was rebranded as 100% coconut oil since excise duty cannot be charged on edible products. Marico ended up removing the word ‘hair oil’ from their packaging to ensure they don’t have to pay tax for it. Moreover to make it look like an edible oil they put the green vegetarian symbol on it. Also, it is FSSAI approved. Indeed, avoiding taxes is next to impossible but not for Marico.