It’s that time of the year again, no we know Christmas just went by, but we aren’t talking about that. We are talking about Budget 2022. Yes, that time when newspaper articles are rife with Budget news, channels are raving over what the Budget will entail and office space discussions have an air of “Kya lagta hai Budget ka iss baar?” (What do you think the budget will look like this time?).

With words like Fiscal Deficit, Inflation, Excess Grants, Reappropriation, being used as frequently as “a and the”, a lot of us would start feeling it to be more French than English. It is easy to get lost in the myriad of words that are soon going to come your way. We are here to help you make sense of what is about to come and more so enable you to not just listen to ‘budget discussions’ but participate and make sense of it. Because, not beating around the bush, it is important.

Just like you would have a rough estimate of how much you want to spend in a month on junk food, shoes and rent, the government creates its own estimate of how much it wants to spend on the country in different fields like education, sanitation, food etc. The former is your budget and the latter is The Union Budget. In plain words, an estimate of the income and expenditure for the country.

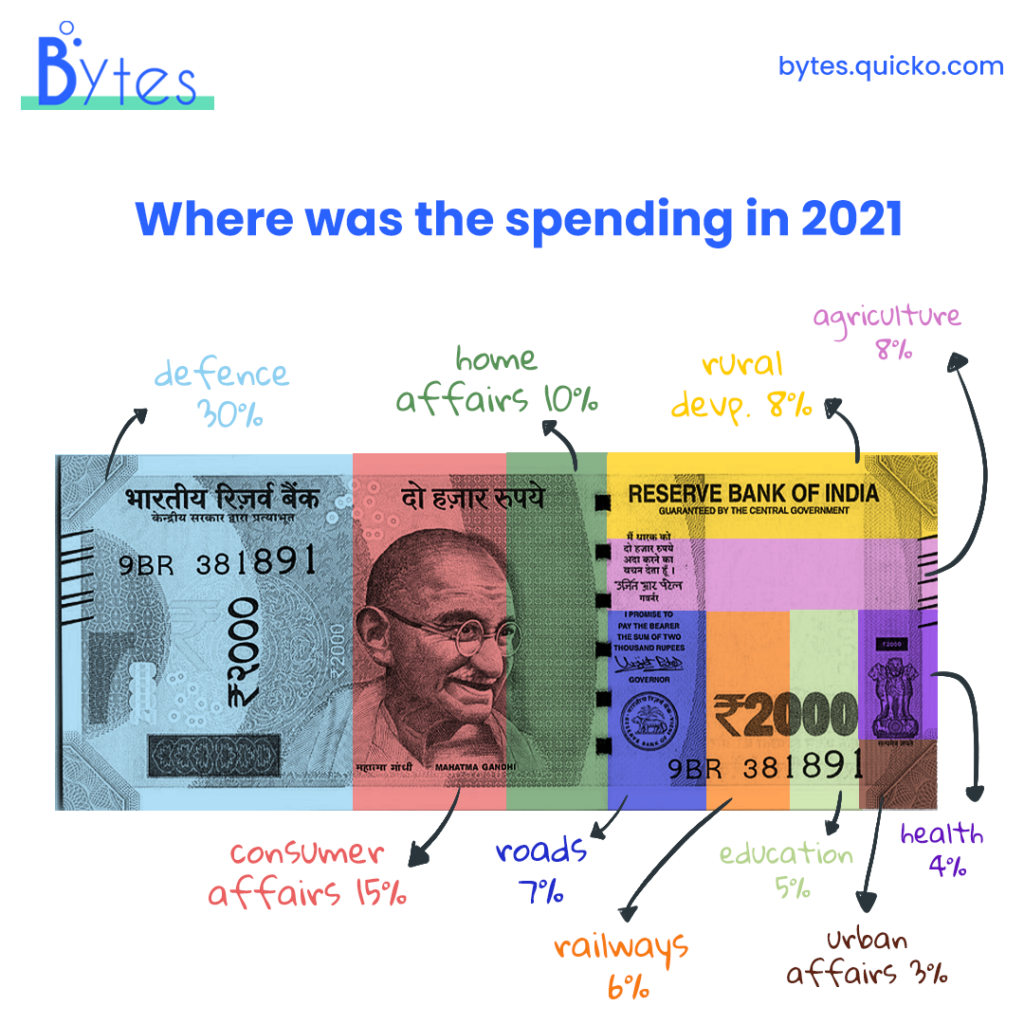

At the end of the day, even the government can be juxtaposed to any other salaried employee, obviously the proportions vary. Even the government has income streams and has certain expenses. Some of the many expenses are building flyovers, setting up industrial parks, and creating better rail networks. To be able to pay for the expenses, the government needs to earn and where does it earn from, you guessed it right, Taxes, of various kinds like income tax, customs, GST. All in all, the government creates a ‘list’ that manages these incomes and expenses. Projects are laid out, taxes are raised and reduced and the occasional parliament jestering happens during the Budget Session which takes place on the 1st of February every year by the Finance Minister of the country.

The budget is released as a statement which is divided in two parts: Capital Budget and Revenue Budget

Capital budget contains “capital receipts and payments”. Receipts basically include loans raised by the government from the public, RBI and other foreign bodies. Payments consist of expenses on land acquisition, buying machinery and other equipment.

Revenue Budget consists of the revenue that the government earns and spends, like the revenue the government earns from taxes, earns from investments, dividends. And where it gets spent like functioning of various government departments, subsidies and other interests. All the expenses that do not lead to the creation of assets are treated under Revenue Budgets.

All of what will happen on 1st February will happen under these two segments. Some predictions for Budget 2022, say that Corporate India has fared well over the past year with low interest rates but other micro and small industries and rural India has been struggling and hence the government might allocate funds to those places. There have been speculations that agriculture might be incentivized in the backdrop of elections in two agriculture dominated states of UP and Punjab. Some say that the Hospitality industry shall be extended support and given grants (time to pay off loans and relaxation in taxes and duties) after it being one of the worst hit industries post Covid. While the others say that Electric Vehicles might be given a push. And in one corner there’s a few who are still saying “What about Crypto?”

Enjoy some halwa, because the finance ministry will (look up on it) and brace yourselves because the Budget is coming.

This is what we think our #Wordle board may look like