After much speculation, Finance Minister Nirmala Sitharaman presented budget 2020 on 1st February. The first budget speech of the decade was the longest & probably the most confusing.

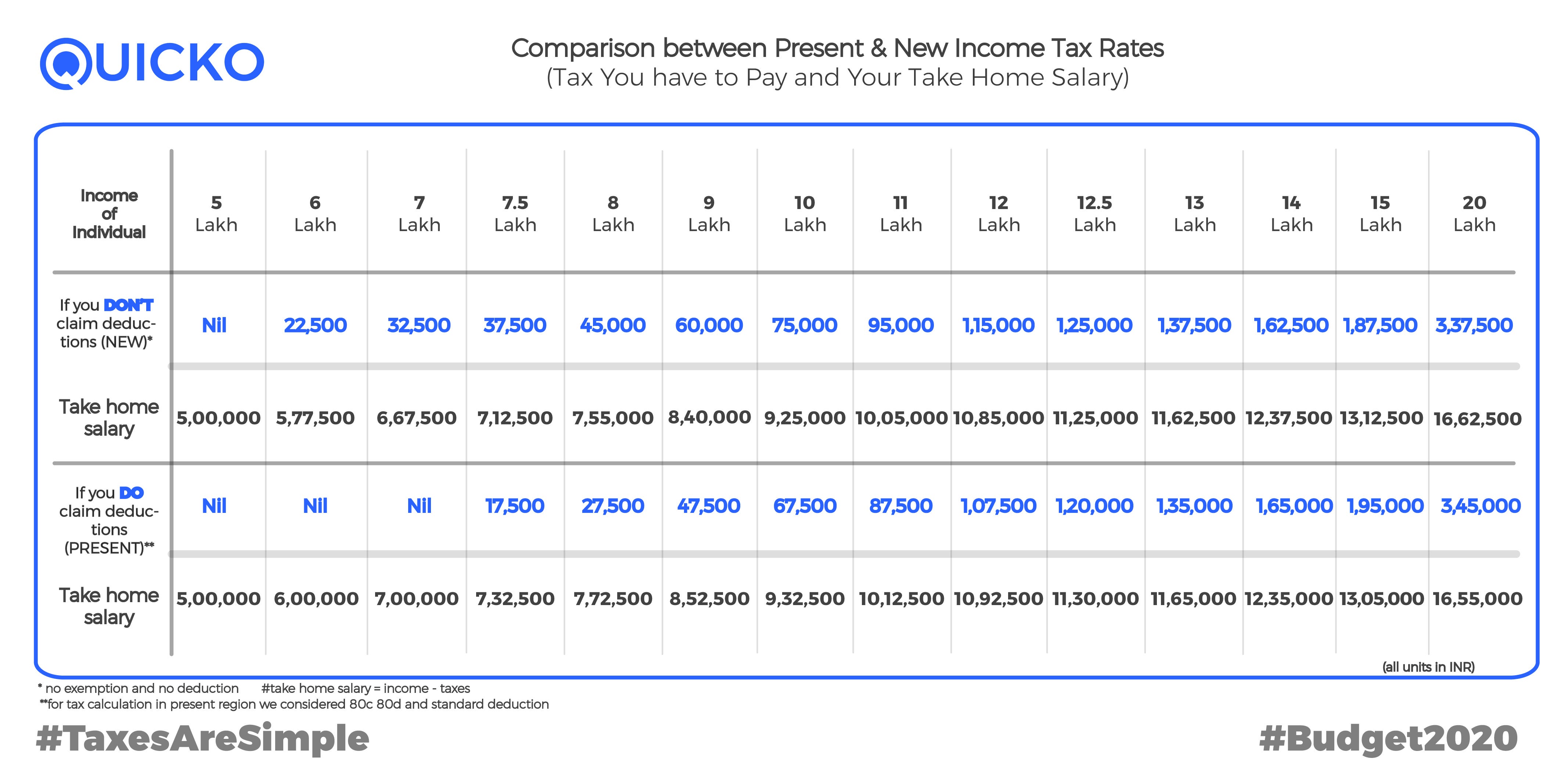

Too many options for taxpayers? Budget 2020 Highlight was clearly FinMin giving taxpayers an option to choose from the Incumbent tax System and New Tax System. Prior to the Budget, there were several expectations in the market around a possible Tax Slab Overhaul. The ‘New Tax Regime’ as she called it aims at simplifying Income Tax. Well, it has created all the more confusion…. Talk about Irony 😛

Blue Pill- Red Pill… Salaried People were left wondering which Tax System to follow? Should you choose the Current Tax Regime, you can continue to claim tax deductions. On the other hand, Under the New Tax regime, you cannot avail any deductions but could have more Take Home Salary.

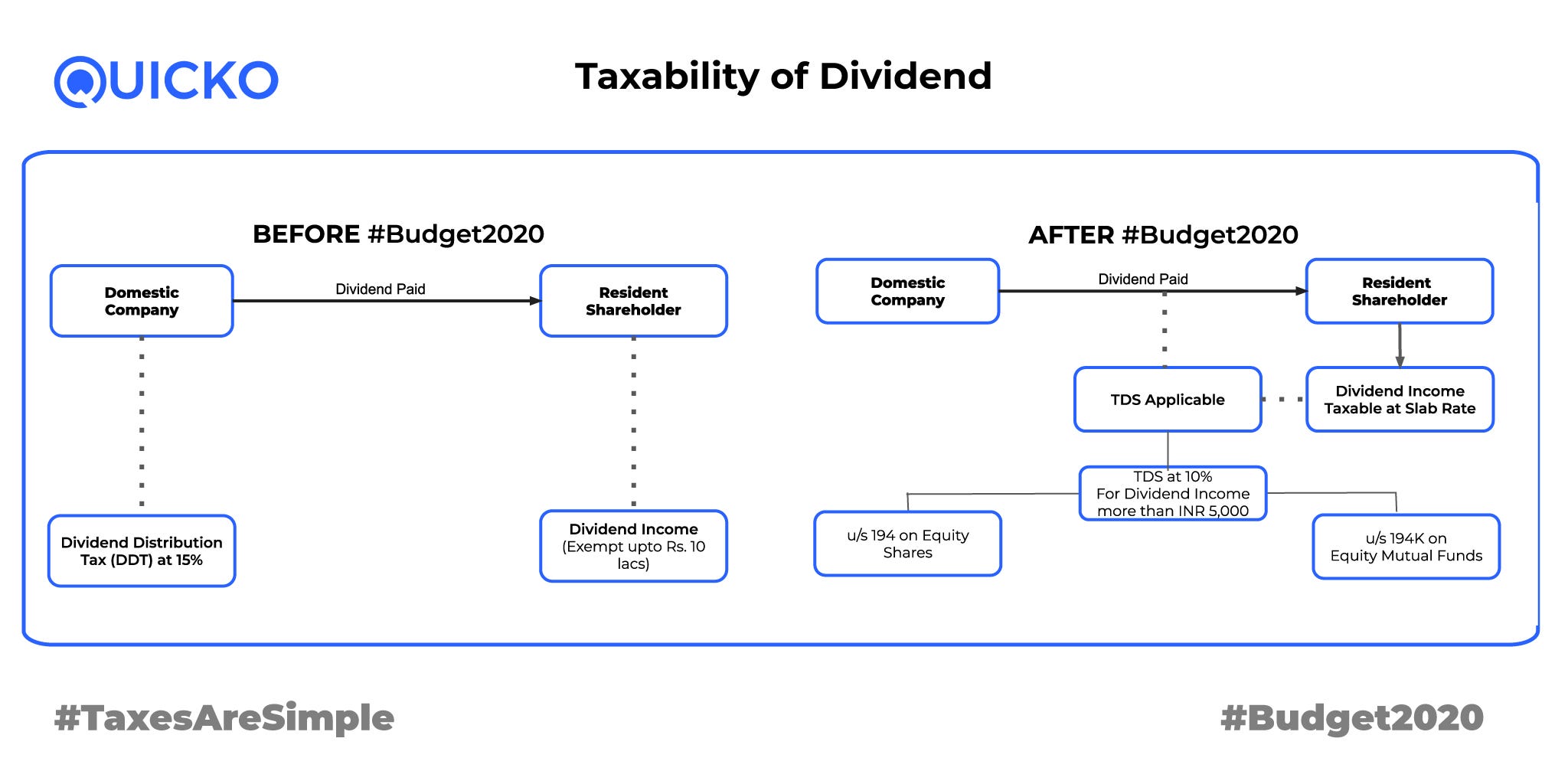

Bye-Bye DDT… There was a raging controversy where companies were confused about TDS on Capital Gains. A clarification was later issued by CBDT. In the Budget speech, Finance Minister Nirmala Sitharamn announced that the Dividend Distribution Tax was to be abolished for the companies. Instead, Dividend is now taxable in the hands of the Shareholders as per applicable slab rates. According to the newly amended Section 194 and 194K, Dividend Incomes in excess of INR 5,000 is liable for a 10% TDS. Note: Income from Capital Gains is excluded.

Insurance Overhaul… FinMin announced a changed limit of Deposit Insurance from INR 1 Lakh to INR 5 lakh. Well, it’s safe to say that it surely is a big leap, but India is far behind developed countries in terms of deposit insurance. For instance, the average deposit insurance in the U.S is $2,50,000. There is a long way to go!

Happy Business?… MSMEs were also addressed in the Budget. NBFCs to offer invoice financing to MSMEs. Also, the turnover limit for tax audit was increased from the existing INR 1 crore to INR 5 crores. However, this does not apply to businesses where cash transactions are more than 5% of the turnover. Is this government’s way to boost #DigitalIndia?

GST taken down a notch? Rejoice! GST was simplified in the Budget. Apparently, NIL GST Returns can be filed via SMS. FinMin also announced that the Finance Department is working to automate the GST Return filing process. Fingers Crossed, the GST due dates won’t cause any panic. In other news, GST collection crossed over INR 1.1 Lakh Crore in January.

–Nirmala Sitharaman

😕 Why every NRI can relate to this picture? Budget 2020

Why Stock Markets defy the Economy!